In September 2017 the Commission published its first joint report on monitoring developments in the EU market for the provision of statutory audit services to PIEs.

The Commission then uses these reports to draw up joint reports covering the whole EU. Regulation No 537/2014 requires national authorities responsible for audit oversight and the European Competition Network to draw up reports on developments in the national markets for statutory audit services to public-interest entities (PIEs). The CEAOB contributes to the proper application of EU audit legislation by facilitating supervisory convergence. The Committee of European Auditing Oversight Bodies (CEAOB) was established in 2016 to improve cooperation between European national audit authorities in the EU. Study on the Audit Directive (Directive 2006/43/EC as amended by Directive 2014/56/EU) and the Audit Regulation (Regulation (EU) 537/2014)Ĭooperation between European national audit authorities a regulation ( Regulation No 537/2014) that specifies requirements for statutory audits of public interest entities (PIEs), such as listed companies, banks and insurance undertakings.an amending directive ( Directive 2014/56/EU) that sets out the framework for all statutory audits, strengthens public oversight of the audit profession and improves cooperation between competent authorities in the EU.These rules help to foster diversity in the audit markets and enhance investors' trust in the financial information of companies, which in turn improves the conditions for cross-border investment and economic growth in the EU. In the case of public interest entities (PIEs), for example, auditors will rotate on a regular basis and will no longer be allowed to provide certain non-audit services to their audit clients. PIEs are listed companies, credit institutions, insurance undertakings, or other undertakings designated by EU countries to be of public importance.

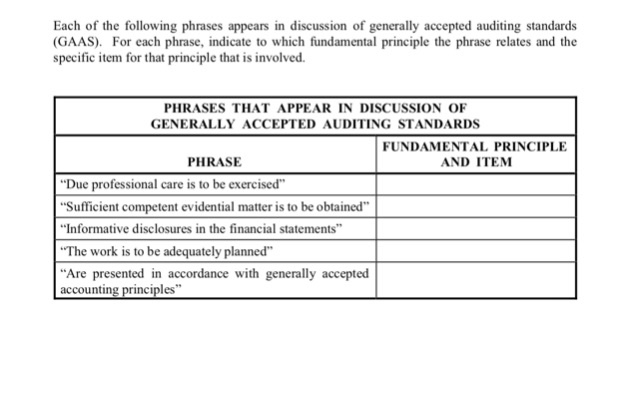

#REVIEW OF GENERALLY ACCEPTED AUDITING STANDARDS PROFESSIONAL#

They aim to improve statutory audits in the EU by reinforcing auditors' independence and their professional scepticism towards the management of the audited company. The current rules were adopted in April 2014.

As a result, statutory audits contribute to the orderly functioning of markets by improving the confidence in the integrity of financial statements. An audit provides stakeholders such as investors and shareholders with an opinion on the accuracy of companies’ accounts. The role of a statutory audit is to certify the financial statements of companies or public entities. A statutory audit is a legally required review of financial records.

0 kommentar(er)

0 kommentar(er)